This is just a simple tutorial on how you can estimate your weekly checks prior to arrival. This will give you a general idea on what you need to do - money wise.

Go to http://www.paycheckcity.com/calculator/hourly/

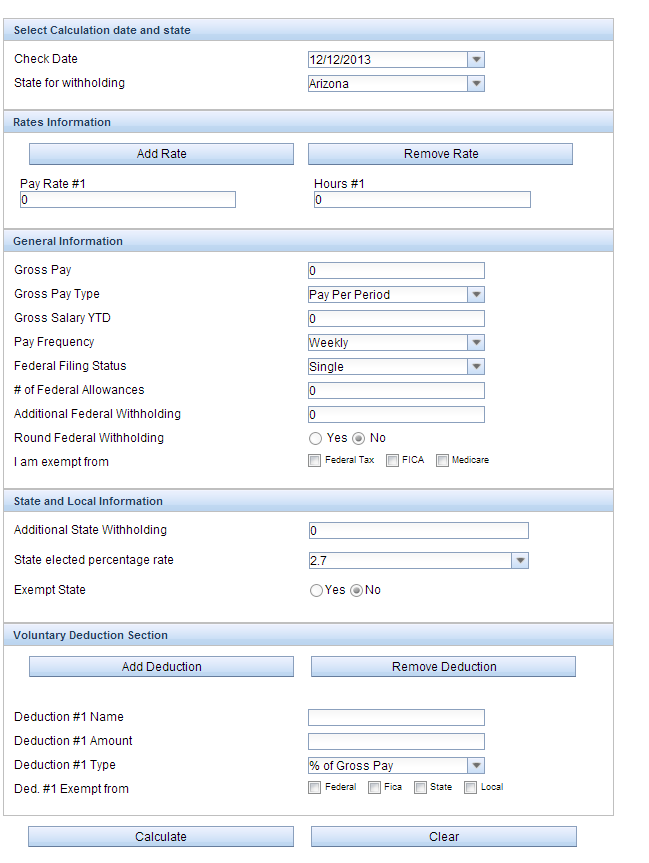

This is the form default.

You will need to fill in the worksheet as I describe below in this post.

INSTRUCTIONS

2. Pay Rate #1: Your Pay Rate

3. Hours #1: Estimated hours - make sure to include your break

4. Gross Pay: This will automatically be calculated

5. # of Federal Allowances - Enter "0" or "1" - Put "0" for more tax to be taken out and to get more after you file taxes. Choose "1" to have less taxes taken out and to receive little to no money after you file taxes.

6. Deduction #1 Name - You can add as many deductions as you like for anything you want. This can be named Disney Housing Rent, Phone Bill, Weekly Grocery, etc.

7. Deduction #1 Amount - The numerical amount.

8. Deduction #1 Type - This is important! Please choose "$ Fixed Amount"

9. Click Calculate.

Waiting for the results . . . . . . Then . . . . . .

So, this is the results from the details I entered. As you can see after rent and taxes I will be keeping $159.14 per week to myself.

Notice for "Florida" it says "$0.00" because there are no state taxes in Florida. My numbers are lower because I chose "1" for my federal allowances.

Using the number I got from this we can do some estimations. I'm basing this entirely off the Spring Advantage program:

Waiting for the results . . . . . . Then . . . . . .

So, this is the results from the details I entered. As you can see after rent and taxes I will be keeping $159.14 per week to myself.

Notice for "Florida" it says "$0.00" because there are no state taxes in Florida. My numbers are lower because I chose "1" for my federal allowances.

Calculating My Pay

Using the number I got from this we can do some estimations. I'm basing this entirely off the Spring Advantage program:

- Spring advantage its January - August.

- My exact dates are Jan 20th-Aug 8th.

- We get paid every Thursday (weekly).

Spring Advantage Pay Days 2014

Jan - 1 Payday - Jan 30th - This will be the lowest paycheck. NO RENT will be taken out of this check because we paid a fee remember.Feb 6 - 1st rent payment taken out. 13, 30, 27

March 6, 13, 20, 27

April - 3, 10, 17, 24

May - 1, 8, 15. 22, 29 (Paid 5 Times)

June - 5, 12, 19, 26

July - 3, 10, 17, 24, 31 (Paid 5 Times)

August

8 - My departure day I get paid.

15 - No rent taken out. This will come on your Direct Deposit AFTER your program. So, this will be one your higher paychecks.

Estimations

How much I make:

per week (after tax and rent): $159.14per month after tax: $636.56 (4 paydays per month) or $795.70 (5 paydays in a month May & June)

entire program after tax for 27 paydays (Does not include 1st or last check): $4,137.64

This based on me working 40 hours a week - 5 days week at the rate of 7.79 (this is for most CPs in QSFB, Custodial, Merchandise, Attractions) with a few hours taken out for my break.

Disclaimer: This does not represent my pay or anyone else, it is simply an estimate based on the typical CP base pay rate floating on the forums/groups. The tax rates and amounts are not exact. Just an educated guess for fun and help purposes!

Information & Resources:

Picking Up Extra Hours & Overtime

Direct Deposit & Paysday

0 comments:

Post a Comment